income tax rates 2022 ireland

These rates of VAT have been the same since January 2012 apart from the period from September 2020 to March 2021 when the. We help file income tax returns for individuals across Ireland.

2022 Corporate Tax Rates In Europe Tax Foundation

The personal income tax system in.

. USC Band 2 increased from 20687 to 21295. Listed below are the current VAT rates in Ireland in 2022. Self -employed workers with an income over 100000.

Ireland Income Tax Brackets and Other Information. Budget 2022 announced 12 October 2021 features a total budgetary package of 47bn split between expenditure measures worth 42bn and tax measures worth 05bn. Non-resident companies are subject to Irish corporation tax only on the trading.

4 rows Rates and bands for the years 2018 to 2022. On average European OECD countries currently levy a corporate income. Have a 3 surcharge so they pay 11.

Tax Bracket yearly earnings Tax Rate 0 - 36400. Employee tax credit tax credit increase from 1650 to 1700. The Budget 2022 package includes approximate 520m in tax cuts.

Single and widowed person. Tax Rates and Credits 2022 Value Added Tax changed Standard ratelower rate 23135 Hospitality and tourism newspapers electronically supplied publi-cations and sporting facilities 9 Flat rate for. The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your income tax and.

Ireland Personal Income Tax Rate - values historical data and charts - was last updated on June of 2022. 2022 EUR Tax at 20. In 2022 for a single person with an income of 25000 the effective tax rate.

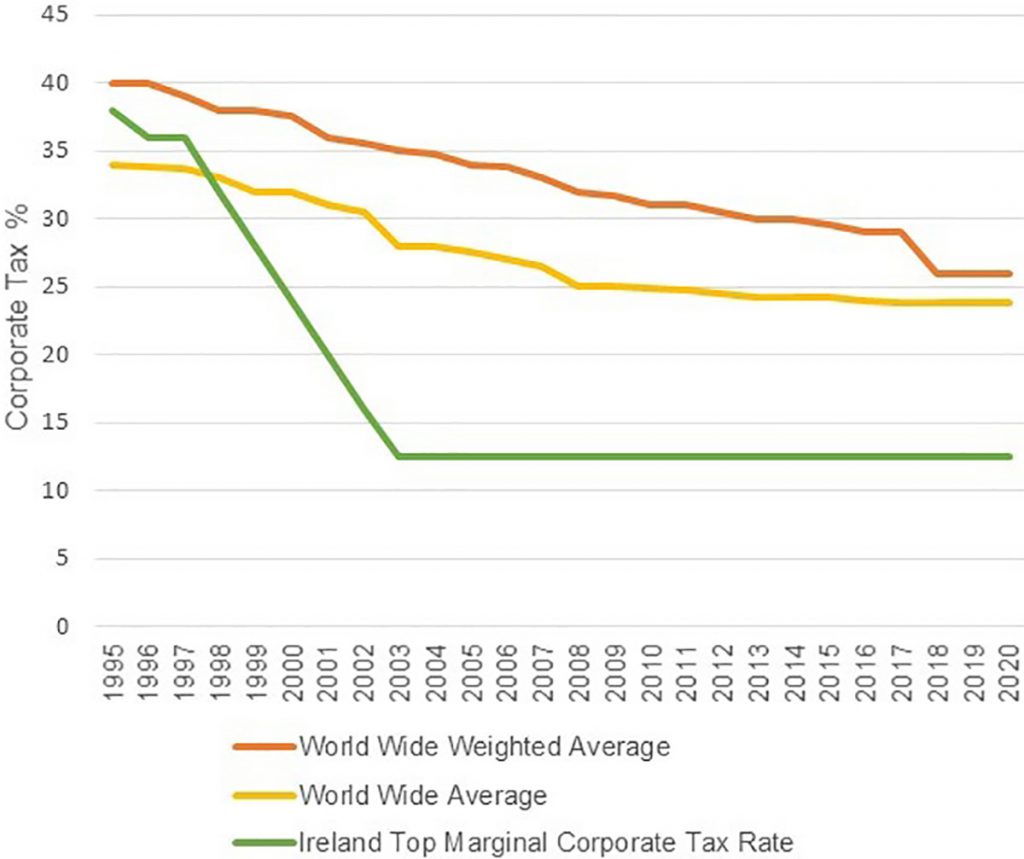

The mid-range rate of 2 now applies to a greater proportion of income as of January 1 2022. Personal Income Tax Rate in Ireland is expected to reach 4800 percent by the end of 2020 according. Hungary 9 percent Ireland 125 percent and Lithuania 15 percent have the lowest corporate income tax rates.

The standard rate tax band the amount you can earn. In England Wales and Northern Ireland the Income Tax Bands are Basic Rate Higher Rate and Additional Rate. Summary of USC Rates in 2022.

Ad A high quality low cost individual tax return service. Use our interactive calculator to help you estimate your tax position for the year ahead. Aggregate income for the year is 60000 or less.

The Irish government announced in connection with Budget 2022 released October 12 a planned increase in the corporate tax rate to 15 in line with last weeks. By Doug Connolly MNE Tax. We help file income tax returns for individuals across Ireland.

Heres all the new changes that will affect you in 2022. 8 rows PAYE earners. For more details check out our detail section.

This money has been accredited to changes to income tax bands that will enable two-thirds of. Individuals aged under 70 who hold a full medical card whose aggregate income for the year is 60000 or less. The rates of 20 and 40 will remain as they are but the standard tax rate band ie the amount you earn before paying the.

Tax-rate band increases. Ireland Income Tax Brackets. Standard rate band increased by.

Resident companies are taxable in Ireland on their worldwide profits including gains. 2021 Rate 2022 Rate Income up to 05. Ad A high quality low cost individual tax return service.

Ireland Annual Salary After Tax Calculator 2022. Earned income tax credit increase from 1650 to 1700. Workers on this rate will notice an increase in the money they take home which is now at 1520.

In Scotland the Income Tax bands are Starter Rate Basic Rate Intermediate. 12012 21295 2. 0 12012 05.

The income tax system in Ireland has 2 different tax brackets. Get a quick quote today. Get a quick quote today.

What will the provisions contained in Budget 2022 mean for you. Income tax rates will stay the same at 20 and 40 but there will be increases to tax credits and changes to the income tax bands.

U S Individual Income Tax Tax Rates For Regular Tax Highest Bracket Iittrhb Fred St Louis Fed

Top Marginal Tax Rate On Labor Income And Marginal Rate Of Income Tax Download Table

2022 Capital Gains Tax Rates In Europe Tax Foundation

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Marginal Tax Rate Formula Definition Investinganswers

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

How Do Taxes Affect Income Inequality Tax Policy Center

Biden S Minimum Corporate Tax Rate Could Destroy Ireland S Economic Growth Model Leaving The Country In Uncharted Territory The Loop

What Could A New System For Taxing Multinationals Look Like The Economist

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Korea Tax Income Taxes In Korea Tax Foundation

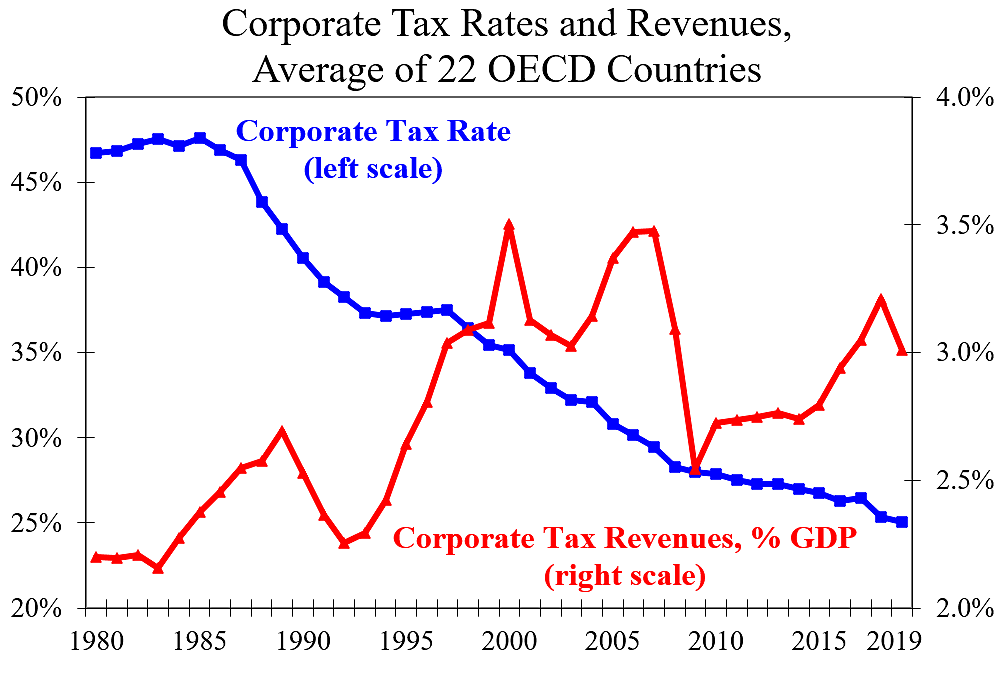

Corporate Taxes Rates Down Revenues Up Cato At Liberty Blog

Korea Tax Income Taxes In Korea Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World