reverse tax calculator bc

Current provincial sales tax pst rates are. Reverse Sales Tax Formula.

Reverse Calculation Of Tax Using Calculation Type H Sap Blogs

The following table provides the GST and HST provincial rates since July 1 2010.

. See the article. In the province of British Columbia your tax rate can be as low as 506 if your annual income is 43070. Amount with sales tax 1 GST and.

The rate you will charge depends on different factors see. Reverse Tax Calculator For Bc. You have a total price with HST included and want to find out a price.

Type of supply learn about what. Provinces and Territories with GST. Canada Sales Tax Chart Date Difference Calculator.

04 pst on the purchase of energy products. Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon. The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association.

That means that your net pay will be. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. This reverse tax calculator will help you to know the.

Reverse Sales Tax Rates. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC. How to use HST Calculator for reverse HST Calculation.

British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. 55 if manufactured modular home. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Formula for calculating reverse GST and PST in BC. It is very easy to use it. Provinces and territories with gst.

If youre looking for a reverse. Tax rate for all canadian remain the same as in. The information used to make the tax and exemption.

If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Most goods and services are charged. Reverse GST Calculator.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. And as high as 205 if your income is over 227091. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator.

This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. The information used to make the tax and exemption calculations is accurate as of january 30 2019. Current HST GST and PST rates table of 2022.

Canada Sales Tax Calculator On The App Store

How To Calculate Sales Tax In Excel

Essential Tax Numbers Updated For 2022 Advisor S Edge

Sales Tax 101 For Canadian Startups Quaderno

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Canada Tax Calculator Gst Hst On The App Store

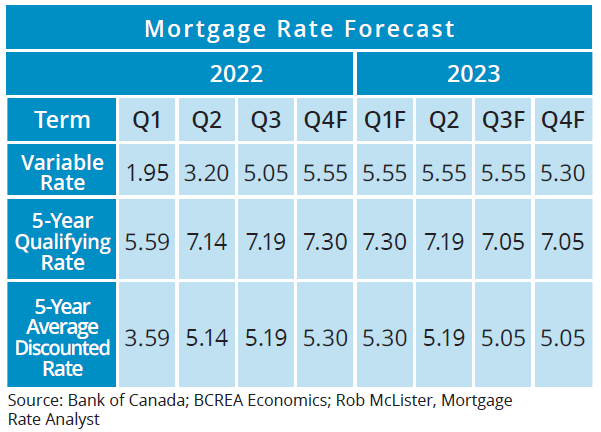

Mortgage Rate Forecast British Columbia Real Estate Association

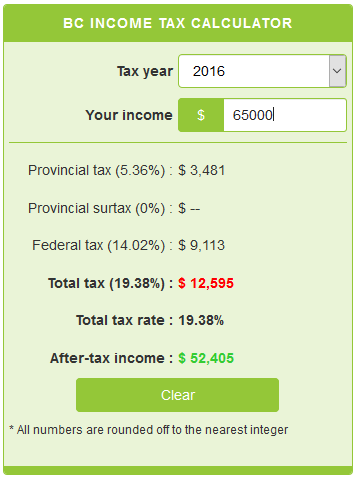

Income Tax Calculator Calculatorscanada Ca

![]()

Canada Tax Calculator Gst Hst Skachat Prilozhenie Na Appru

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Greek Coin Ar Tetradrachm 454 404 Bc Ebay

How To Calculate Reverse Sales Tax

Canada Tax Calculator Gst Hst On The App Store

85000 Income Tax Calculator British Columbia Bc Canada 2020

British Columbia Income Tax Calculator Calculatorscanada Ca

Saskatchewan Gst Calculator Gstcalculator Ca